The Cumulus Media/Westwood One Insights team took a look at the recently released Q1 2021 edition of Share of Ear by Edison Research. The latest blog post and video focuses on the reach of AM/FM radio and what the data means to advertisers.

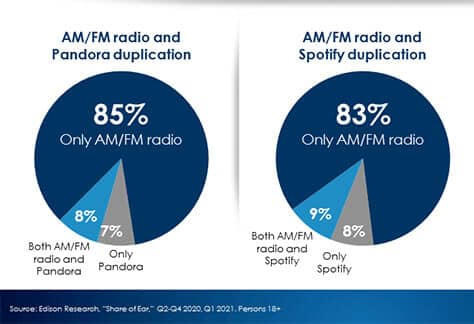

Chief Insights Officer Pierre Bouvard pointed out that an advertising program needs to include streaming, but placing ads solely on Pandora or Spotify is not enough. Adding AM/FM radio advertising generates a massive increase in reach. In fact, most people listen to just AM/FM radio and not Pandora, Spotify or SiriusXM. There is some crossover, with people listening to both AM/FM radio and a streaming service. Thus, an ad running on AM/FM radio would reach the crossover audience at zero cost.

Chief Insights Officer Pierre Bouvard pointed out that an advertising program needs to include streaming, but placing ads solely on Pandora or Spotify is not enough. Adding AM/FM radio advertising generates a massive increase in reach. In fact, most people listen to just AM/FM radio and not Pandora, Spotify or SiriusXM. There is some crossover, with people listening to both AM/FM radio and a streaming service. Thus, an ad running on AM/FM radio would reach the crossover audience at zero cost.

The blog also notes that Nielsen Media Impact, the media planning and optimization platform, reports that increased investment on Pandora and Spotify yields very little reach growth. The same investment levels on AM/FM radio generates triple the reach.

Also of interest to advertisers is that most Spotify/Pandora listening occurs at home, in a laid back manner, i.e. mostly for background music. The majority of AM/FM radio listening occurs away from home, in the car and at work, and is a lean-in entertainment and information service. Pandora and Spotify have only two-thirds of the attention and audibility of AM/FM radio, therefore ads running on streaming may not be actively heard.

AM/FM radio’s in-car share of ad-supported audio is 87%, unchanged from a year ago. “AM/FM radio is the smart choice to reach hundreds of millions of Americans on the path to purchase,” said the Insights blog.

Additionally, on smart speakers, AM/FM radio is the most listened to ad-supported platform.

AM/FM radio remains dominant in ad-supported audio. Between Pandora, SiriusXM and Spotify, the audience share has not grown. However, podcasting’s share of audience has tripled since 2017 (5% in Q1 2017 to 15% in Q1 2021) among adults aged 25–54.