As radio operators worldwide consider their futures and the innovations needed to get there, they should consider the cautionary tale of the United States’ radio landscape. Once, radio consultants and executives came to the U.S. to discover the latest ideas and trends. They have now largely stopped, looking elsewhere for inspiration. But you can still look to the U.S. as a warning signal. Because alternative sources are rapidly replacing U.S. radio listening, and the remaining audiences are concerningly old.

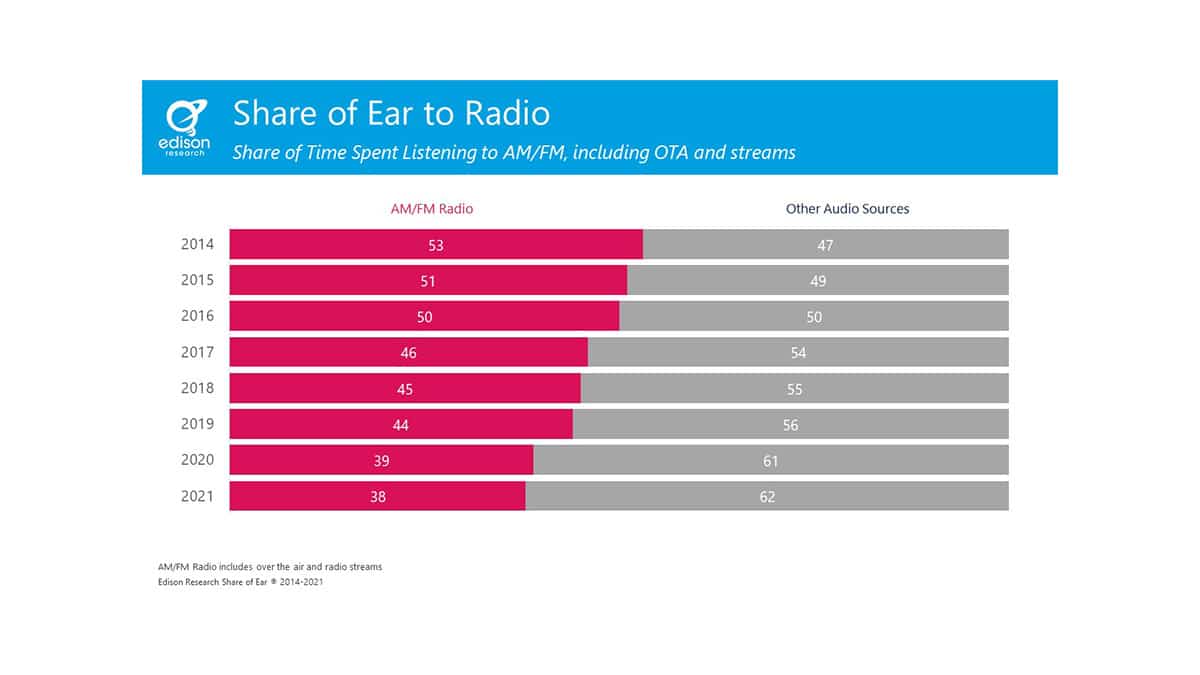

Edison Research has been publishing our unique Share of Ear survey since 2014. With so many years to look at and such a dynamic market, the time series data is an authentic document of change. Share of Ear measures all audio — radio, streaming, podcasts, music videos on YouTube, audiobooks, owned music, essentially anything people spend time listening to.

The graph above shows the share of all audio time that goes to radio. As you can easily see, radio’s share is declining. On average, the compound loss is about 5%.

But these losses are not equal across the board. Keeping note of the 38% overall share for radio, look below at the share by age group.

The myth of free radio

As of our most recent public report, among those over 55 years of age, still fully half of their audio time goes to radio. Meanwhile, among 13–34s, that share has fallen to less than 20%; plus, their rate of decline is much higher than that of older age groups. Today, nearly half of all radio listening time in the U.S. is by those ages 55 and older. This explains the market-leading ratings from so many “classic hits” and “classic rock” stations, the ascendance of the NPR-driven public radio sphere, and the improved lot of many mainstream AC stations.

At the same time, another trend has gripped U.S. audio consumption — the willingness to purchase a way out of hearing advertising. This phenomenon is mirrored on the video side — Netflix, Disney+ and HBO Max, among others, show how many people will subscribe. We estimate that just under one-half of all Americans now subscribe to a paid service that eliminates ads — from Spotify Premium to Apple Music and the satellite radio service SiriusXM.

There are a couple of things to consider. First, while there is no way to show the causal link, the increase in commercial loads on many U.S. radio stations is undoubtedly a factor in driving people to these paid services.

At some point, considering the “cost” of listening to 18 minutes of commercials per hour for “free” radio, maybe paying US$6 or even $10 or $15 for their elimination is actually a bargain. Second, while there are certain strata of American life for whom such prices are a luxury, for the overwhelming majority, ten bucks each month is a triviality.

Yes, radio is “free,” but it is just not the case that “nothing can compete with free.” Increasingly, the value proposition between “free with many commercials” and “no commercials but a few dollars per month” biases the latter.

The bold move

We see the impact in Share of Ear. When we started tracking this data in 2015, 71% of all audio consumption was ad-supported. Today, that number has dropped to 60%. More than half of listening among those 13–34-years old is now ad-free. If you are a “radio innovator,” you should be thinking: “ad-free” options.

The American radio market’s structural aspects differ from those in other countries. We don’t have a state broadcaster to foster the medium, as many other countries do. Our biggest operators are public companies carrying substantial debt. Shareholder demands and debt payments hinder long-term thinking and investment and encourage cost-cutting.

Thus, very little is spent on what would stem the tide: talent development, promotion, marketing and research. With almost no one live on the air anymore outside of weekday daytime, there’s little pipeline for new talent.

Make cultivating new, young radio listeners your key effort in the remainder of 2022 and beyond.

Radio companies in the U.S. are doing the only things they can — diversifying beyond AM/FM by expanding into podcasting, becoming resellers of Google and Facebook for their trusted local clients, and developing streaming apps.

They have stopped even trying to build the “top of the funnel” and attract new young people to the medium. In almost every city in the U.S., there are no shows expressly for teenagers or young adults, no outreach to high schools or colleges, and at best minimal and desultory social media campaigns.

If you take nothing else from the U.S. radio story, make cultivating new, young radio listeners your key effort in the remainder of 2022 and beyond.

The author is president of Edison Research.