COLOGNE, Germany — Car manufacturers have recently launched YouTube, TikTok, app stores and games to increase the choice of entertainment in addition to radio, podcast and music streaming services. As the world of infotainment changes and a myriad of content choices make their way into the dash, giving users exactly what they want when they want it, and in a safe and frictionless manner becomes paramount.

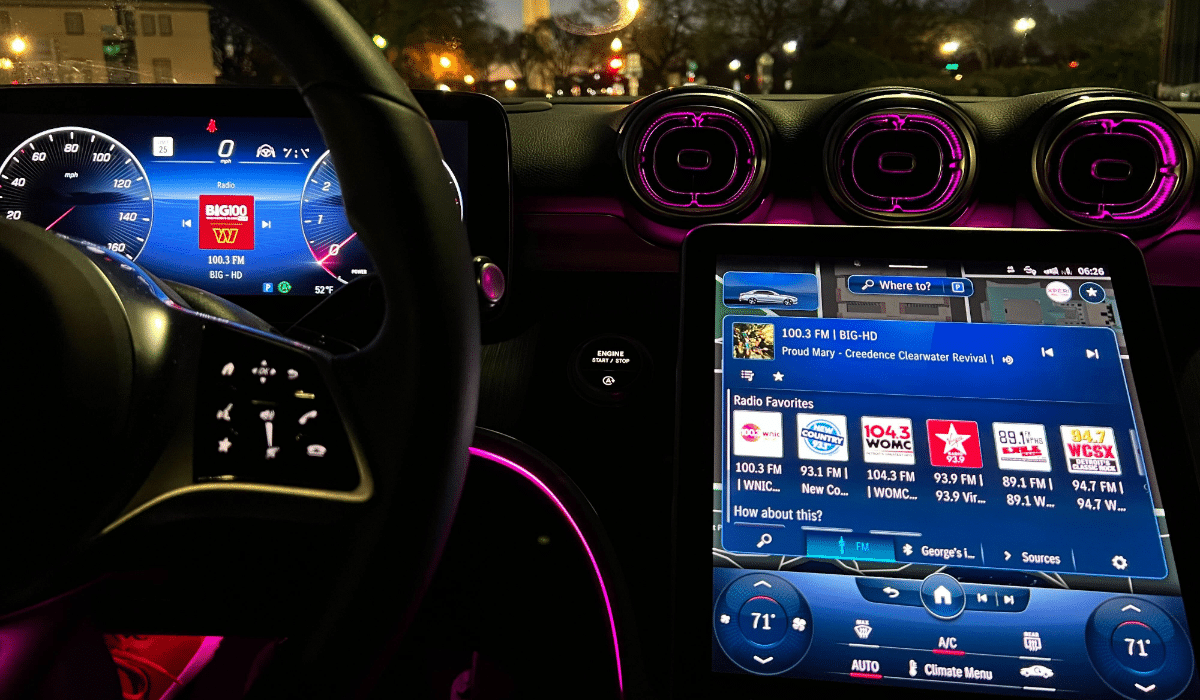

The number of distribution channels for mobile audio use continues to grow. Radio listening in the vehicle via the built-in infotainment system remains high, with 73% in 2022 — a slight drop from 76% in the previous year. Radio may currently be the most used infotainment source in the car, but other distribution channels and content sources are gaining popularity.

Spotify, for example, offers over 100 million music tracks and five million podcasts, and on YouTube, over 500 hours of content are uploaded per minute by its billions of monthly logged-in users. Social media and entertainment companies are looking for additional ways to bring their content to in-car customers who will spend more time looking at screens in their vehicles.

Vehicles as “the third place”

On Dec. 9, 2021, Mercedes-Benz became the first automotive company to meet the very demanding legal and technical requirements of UN-R157 for a Level 3 autonomous system. Then on June 22, 2022, the United Nations Economic Commission for Europe (UNECE) announced a new milestone with the adoption of a proposal to extend automated driving in certain traffic environments from the current limit of 60 kmph up to 130 kmph. The United Kingdom government has announced it intends a widespread rollout of self-driving vehicles on its roads by 2025.

Vehicles are transforming into what the American urban sociologist Ray Oldenburg called “the third place” — a home away from home, a separate place from home and workplace, one with a playful mood. New mobility concepts enable broader entertainment consumption and new use cases. The introduction of codriver displays is just a start — BMW has taken it a step further and introduced a 31.3-inch theater screen in the rear cabin. These displays need meaningful and relevant content.

Companies like Google, with Android Automotive OS, or Apple, with CarPlay, understand this opportunity and are seeking a much deeper integration into the vehicle infrastructure. Their unstated but widely understood goal is to provide a more integrated user experience to monetize user data. At the same time, car manufacturers have realized the importance and value of customer and vehicle data. Instead of handing control and user data over to Big Tech, car manufacturers are looking for alternative solutions such as DTS AutoStage. This independent media platform provides similar benefits but without requesting data ownership. Instead, the customer relationship remains with the car manufacturers along with the ownership of data.

Car manufacturers with access to in-vehicle analytics can understand which service is being used and which is the most or least popular. Furthermore, they can better understand in-vehicle consumer behavior and what makes a loyal customer.

An automotive distribution strategy

As an increasing amount of content makes its way into connected vehicles, the automotive industry is facing a user experience issue, which boils down to search, find and discover. The consensus is that radio plays an important role in in-vehicle infotainment due to its loyal listener base, but finding the right radio station has become more difficult in a content-rich dash. For example, Munich has more than 130 FM and DAB stations on-air. Finding the right content is challenging — something German media authorities have recognized. So, they have published a list of public value radio stations that listeners should find easily and which deserve prominent placement on smart TVs, set-top boxes or media content displays in vehicles.

To meet this demand, car manufacturers introduced a combined FM and DAB station list and are now moving toward a recommendation carousel that presents personalized radio, podcast, playlist or video content in one centralized view.

However, recommendations need to be meaningful and accurate. Car manufacturers with access to in-vehicle analytics can understand which service is being used and which is the most or least popular. Furthermore, they can better understand in-vehicle consumer behavior and what makes a loyal customer.

Aside from the content discovery challenge, radio needs a new approach to stay relevant in the connected vehicles of today and tomorrow. This requires an automotive distribution strategy with access to in-vehicle analytics. Importantly, it must be via a global and scalable automotive independent media platform where broadcasters keep editorial control over their content. Recognizing this, leading broadcasters worldwide are partnering with Xperi’s DTS AutoStage platform and taking advantage of the built-in discovery functionality and the ability to enrich their content with high-resolution images, lyrics, events and podcasts to provide an experience that is taking radio into the future.

The author is Xperi’s vice president of automotive sales and strategy for EMEA.